Construction Partners (ROAD)·Q1 2026 Earnings Summary

Construction Partners Smashes Q1 Expectations, Raises FY26 Guidance on Record Backlog

February 5, 2026 · by Fintool AI Agent

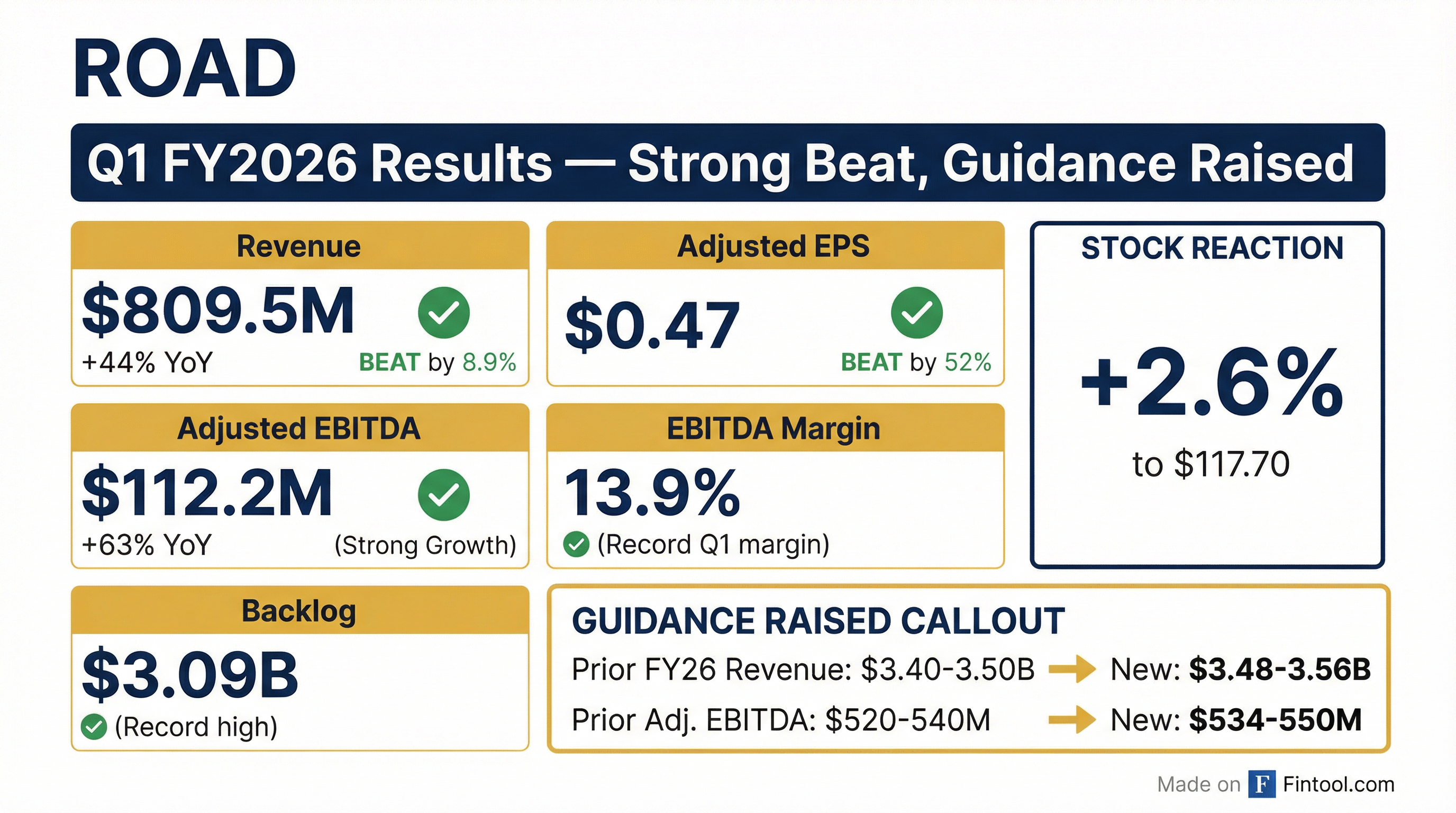

Construction Partners (NASDAQ: ROAD) delivered a strong Q1 FY2026, beating revenue and earnings estimates while raising full-year guidance. Revenue grew 44% year-over-year to $809.5 million, handily exceeding the $743.1 million consensus estimate. Adjusted EPS of $0.47 crushed the $0.31 estimate, helped by record Q1 EBITDA margins and favorable weather conditions. The stock rose 2.6% following the release.

Did Construction Partners Beat Earnings?

Revenue: $809.5M vs $743.1M estimate — Beat by 8.9%

Adjusted EPS: $0.47 vs $0.31 estimate — Beat by 52%

GAAP EPS: $0.31 vs $(0.06) year-ago

The revenue beat was driven by strong operational execution across CPI's family of companies combined with favorable first-quarter weather. Adjusted EBITDA margin of 13.9% marked the highest first-quarter margin in the company's history.

What Did Management Guide?

Construction Partners raised its FY2026 outlook across all metrics, reflecting Q1 outperformance and contribution from the recently closed Houston acquisition.

The FY26 revenue outlook continues to anticipate organic growth of approximately 7% to 8%.

What Changed From Last Quarter?

Record Q1 Margins: Adjusted EBITDA margin of 13.9% was the highest Q1 margin in company history, up 160 bps from 12.3% a year ago.

Accelerating M&A: CPI completed eight strategic acquisitions in the past 15 months, including four in Texas and three platform companies. This quarter saw two acquisitions in Daytona Beach, Florida and Houston, Texas, with another Houston acquisition announced earlier this week.

Record Backlog: Project backlog hit a record $3.09 billion at December 31, 2025, up from $3.0 billion at September 30, 2025 and $2.66 billion a year ago.

Balance Sheet: Long-term debt increased to $1.70 billion from $1.57 billion at the end of Q4 FY25, reflecting acquisition financing. The company drew $140 million from its revolving credit facility during the quarter.

How Did the Stock React?

The stock rose approximately 2.6% following the earnings release, trading at $117.70. This extends the stock's remarkable run from a 52-week low of $64.79, representing an 82% gain over the past year.

ROAD has beaten estimates in 6 of the last 8 quarters, establishing a pattern of outperformance that has driven investor confidence.

Key Management Quotes

CEO Jule Smith on execution:

"We are pleased to report a strong start to fiscal 2026, driven by outstanding operational execution across our family of companies and supported by favorable first-quarter weather."

On commercial market tailwinds:

"There are several macro trends that are driving the commercial markets now. Migration to the Sun Belt, but also the reshoring, which is creating a lot of manufacturing facilities moving back to America and people wanting to build in America."

Executive Chairman Ned Fleming on M&A activity:

"Over the last 25 years, it's as active now as it's ever been... We've historically, for the last 25 years, invested capital in growth areas. Houston is maybe the second fastest growing city in the country. So yeah, there are other metropolitan areas that are like that, that we've identified."

On capital allocation discipline:

"We're gonna continue to look at opportunities. We're gonna pass on opportunities that aren't strategically compelling... GMJ is a great example of one where we said, 'Look, this is a great opportunity.' And so we're gonna continue to make acquisitions. We're gonna continue to use cash more and more to pay for those."

Acquisition Strategy Update

CPI's M&A flywheel continues to accelerate. Key developments this quarter:

Recent Deals:

- GMJ Paving (announced Feb 2026) — 12th HMA plant in Houston, located in Baytown on the east side. Adds public infrastructure paving expertise and complements the nearby liquid asphalt terminal at Houston Port.

- Vulcan Asphalt Assets (Oct 2025) — Significantly expanded Houston operations

- Daytona Beach, FL (Oct 2025) — Fully integrated and operating well

M&A Rollover: Approximately $260-280 million of acquisition-related revenue contribution remains for the rest of FY26, including GMJ.

Pipeline: Management describes the deal pipeline as the most active in 25 years, driven by generational transfers of family-owned businesses. CPI positions itself as the "acquirer of choice" due to its family of companies culture.

Commercial Market Highlights

Management highlighted ~1,000 commercial sector projects across eight states this year, reflecting macro tailwinds from population migration, reshoring, and AI infrastructure buildout:

Commercial demand is "steady" with potential for a stronger spring/summer, while public sector backlog has increased modestly.

Financial Health

Cash from operations was $82.6 million in Q1 FY26, up from $40.7 million a year ago. The company expects to convert 75-85% of EBITDA to operating cash flow in FY26. Management expects the GMJ acquisition to be funded with cash, without additional long-term debt.

Backlog Coverage: 80-85% of the next twelve months' contract revenue is covered by the $3.09B backlog.

Q&A Highlights

On Acquisition Pipeline: Executive Chairman Ned Fleming emphasized the robust deal flow: "Over the last 25 years, it's as active now as it's ever been... The generational transfer continues to give us opportunities to do acquisitions, both what I would call tuck-ins as well as platforms."

On Data Center Exposure: CEO Jule Smith highlighted the company's growing data center work as part of broader commercial demand: "In Central Texas, north of Austin, we're currently working on a facility to provide power to data centers in the area for one of the Magnificent Seven." Management noted they're building "more data centers than I had the time to list" across their footprint.

On Organic Growth Shortfall: The 3.5% organic growth vs. 7-8% full-year target was explained by two factors totaling ~$19 million: (1) Three North Carolina projects delayed due to customer readiness, now underway; (2) One market where "irrational competition" prompted CPI to redeploy equipment to higher-margin adjacent markets — which happened to be recent acquisitions, so the revenue counted as acquisitive.

On Houston Market Expansion: With the GMJ Paving acquisition, CPI now has 12 hot mix asphalt plants in Houston. CEO Smith praised the integration: "Brad Green and his management team... Houston has started off great. They've made a meaningful contribution to this quarter." GMJ adds public infrastructure paving expertise complementary to Durwood Greene's commercial focus.

On Deleveraging: CFO Greg Hoffman confirmed leverage at 3.18x and reiterated the target to reach ~2.5x by late 2026. The company expects to fund the GMJ acquisition with cash, demonstrating strong cash flow generation: "We've had $250 million worth of purchase price and only borrowed $140."

On Surface Transportation Reauthorization: Management remains confident Congress will complete the five-year reauthorization by September 30: "When you look back, they've always reauthorized the five-year plan, and they've always reauthorized it for higher than the previous bill." The focus on formula funding to states is "good news for CPI."

Forward Catalysts

- Continued M&A: Pipeline is "as active as it's ever been in 25 years" per management; expect both platform and tuck-in deals

- Infrastructure Tailwinds: Public contract awards expected to increase 10-15% in FY26 vs FY25 per ARTBA data

- Margin Expansion: Vertical integration and scale benefits continue to drive profitability improvement

- ROAD 2030 Targets: Path to $6B+ revenue and ~17% EBITDA margins by 2030

- Greenfield Expansion: New HMA plant coming online in Brunswick, Georgia with several more planned for late FY26/early FY27

Risks to Monitor

- Leverage: Debt has grown significantly to fund acquisitions; interest expense was $27.4 million in Q1 vs $18.1 million a year ago

- Weather Sensitivity: Q1 benefited from favorable weather; adverse conditions could impact future quarters

- Integration Risk: Rapid M&A pace requires seamless integration of new operations

- Economic Sensitivity: While public infrastructure is resilient, private commercial demand could slow

The Bottom Line

Construction Partners delivered a clean beat-and-raise quarter. Revenue grew 44% year-over-year, adjusted EBITDA margins hit a record Q1 level of 13.9%, and the company raised FY26 guidance across all metrics. The record $3.09 billion backlog provides visibility into continued growth, while the accelerating M&A activity — described as the most active in 25 years — positions CPI for further market share gains across the Sunbelt.

The investment thesis remains intact: CPI is a well-managed consolidator in a fragmented industry, benefiting from population migration to the Sunbelt, reshoring of manufacturing, AI infrastructure buildout, and disciplined execution. With leverage on track to decline to 2.5x by late 2026 and strong cash flow funding acquisitions, the financial profile continues to strengthen even as the company grows.

Learn more about Construction Partners or read the full Q1 2026 transcript.